The 45-Second Trick For Pvm Accounting

The 45-Second Trick For Pvm Accounting

Blog Article

Fascination About Pvm Accounting

Table of ContentsPvm Accounting for DummiesThe Of Pvm AccountingThe Facts About Pvm Accounting UncoveredThe 30-Second Trick For Pvm AccountingUnknown Facts About Pvm AccountingA Biased View of Pvm Accounting

Make sure that the audit process complies with the legislation. Apply needed building and construction accounting standards and procedures to the recording and coverage of building task.Understand and maintain typical price codes in the accounting system. Communicate with various funding agencies (i.e. Title Company, Escrow Business) relating to the pay application procedure and needs required for repayment. Take care of lien waiver disbursement and collection - https://www.artstation.com/leonelcenteno1/profile. Monitor and fix financial institution concerns consisting of cost abnormalities and examine distinctions. Aid with applying and maintaining internal financial controls and procedures.

The above declarations are planned to define the basic nature and level of work being performed by people assigned to this category. They are not to be interpreted as an exhaustive listing of obligations, tasks, and abilities needed. Workers may be required to perform obligations beyond their typical responsibilities every so often, as needed.

9 Easy Facts About Pvm Accounting Described

You will certainly assist sustain the Accel team to make certain shipment of effective on schedule, on budget, tasks. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Building and construction Accountant executes a range of audit, insurance coverage conformity, and project administration. Functions both independently and within certain divisions to maintain monetary documents and make certain that all records are maintained current.

Principal obligations include, yet are not restricted to, dealing with all accounting features of the company in a prompt and precise fashion and providing records and schedules to the business's certified public accountant Firm in the prep work of all economic statements. Makes certain that all accounting procedures and functions are handled accurately. Liable for all monetary documents, pay-roll, banking and daily operation of the bookkeeping function.

Prepares bi-weekly trial equilibrium records. Works with Project Supervisors to prepare and upload all month-to-month billings. Procedures and concerns all accounts payable and subcontractor settlements. Produces monthly wrap-ups for Employees Payment and General Liability insurance coverage premiums. Creates month-to-month Task Expense to Date records and dealing with PMs to fix up with Project Supervisors' spending plans for each job.

The Best Guide To Pvm Accounting

Effectiveness in Sage 300 Building and Realty (formerly Sage Timberline Workplace) and Procore construction administration software program a plus. https://pvm-accounting.jimdosite.com. Must additionally be skilled in various other computer software systems for the prep work of records, spreadsheets and other audit analysis that may be needed by monitoring. construction accounting. Should have solid organizational skills and capability to focus on

They are the economic custodians who guarantee that building and construction projects remain see this on budget plan, abide by tax guidelines, and maintain financial transparency. Building and construction accountants are not just number crunchers; they are tactical partners in the building procedure. Their primary function is to handle the economic aspects of building tasks, guaranteeing that sources are alloted successfully and financial dangers are minimized.

The Ultimate Guide To Pvm Accounting

By keeping a tight grip on job finances, accounting professionals assist prevent overspending and economic problems. Budgeting is a keystone of successful building and construction tasks, and construction accounting professionals are critical in this regard.

Construction accountants are skilled in these laws and ensure that the project conforms with all tax requirements. To excel in the function of a building accounting professional, people require a solid educational foundation in accountancy and money.

Furthermore, accreditations such as Licensed Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Market Financial Specialist (CCIFP) are extremely concerned in the industry. Building and construction tasks usually entail tight deadlines, transforming guidelines, and unanticipated expenditures.

All about Pvm Accounting

Ans: Construction accountants develop and check budget plans, recognizing cost-saving possibilities and guaranteeing that the project remains within budget plan. Ans: Yes, construction accounting professionals manage tax obligation compliance for building and construction jobs.

Introduction to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms have to make hard options amongst many monetary choices, like bidding on one task over an additional, choosing funding for products or equipment, or establishing a task's profit margin. Construction is a notoriously unstable industry with a high failure rate, sluggish time to settlement, and inconsistent money circulation.

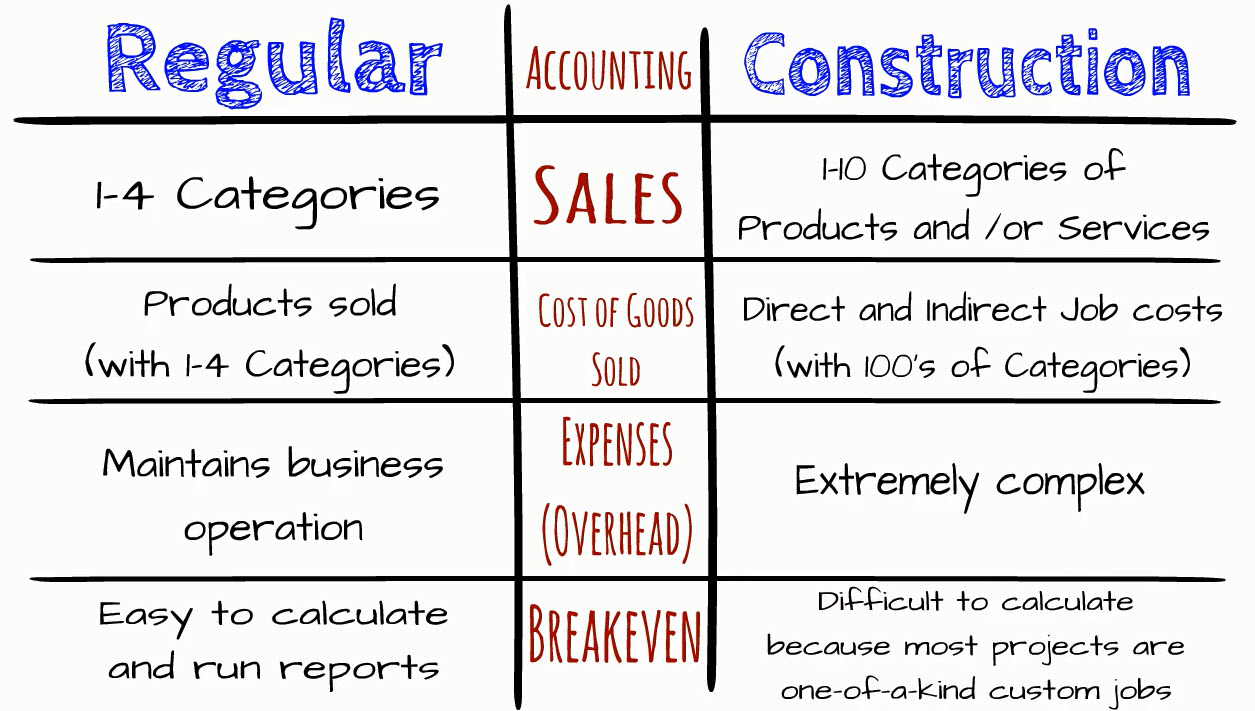

Common manufacturerConstruction business Process-based. Manufacturing involves duplicated processes with conveniently identifiable costs. Project-based. Manufacturing needs various processes, products, and devices with differing expenses. Repaired area. Manufacturing or manufacturing takes place in a solitary (or a number of) regulated locations. Decentralized. Each job occurs in a new area with varying site problems and distinct obstacles.

Some Known Details About Pvm Accounting

Regular use of different specialty service providers and distributors influences effectiveness and cash flow. Settlement shows up in full or with regular settlements for the complete contract quantity. Some section of repayment may be withheld till job completion also when the service provider's work is finished.

Normal manufacturing and short-term agreements bring about workable capital cycles. Uneven. Retainage, slow settlements, and high ahead of time expenses lead to long, uneven capital cycles - construction bookkeeping. While traditional makers have the advantage of regulated atmospheres and optimized production processes, construction companies need to constantly adapt per brand-new job. Even rather repeatable tasks need modifications as a result of site conditions and various other elements.

Report this page